Maximise Return on Assets by Streamlining your accounts Receivable Process

What is Accounts Receivable?

An efficient Accounts Receivable process has a direct and positive impact on maximising your return on assets. A streamlined cash collection process ensures that cash outstanding is kept to a minimum, reducing bad debt, reducing days of sales outstanding (DSO) and improving valued customer relationships.

Embrace noticeably simplifies processes including cash application and credit management. Using security controls and rules helps reduce costs and increase customer satisfaction.

The Embrace Accounts Receivable module

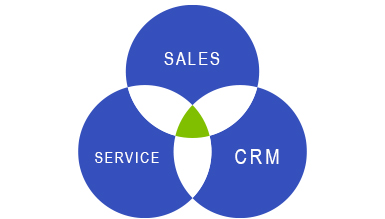

The Embrace Accounts Receivable module is designed to cater for the needs of all trading enterprises, supporting Sales, Service and Customer Relationship Management while providing excellent control and functionality to the Debtors department.

Embrace clients use Accounts Receivable to:

- Improve customer service through company-wide visibility to all account information, including outstanding invoices, sales orders and work in progress

- Keep outstanding cash to a minimum

- Cash application productivity

- Reduce Bad Debts

- Manage credit effectively

- Maintain contact information and healthy customer relationships

- Understand customers’ payment profiles (DSO)

Is Embrace Accounts Receivable for you? Talk to us

Embrace Accounts Receivable

Maximise Return On Assets By Streamlining Your Accounts Receivable Process

Astore Keymak Case Study

Astore Keymak Embrace Improved Performance, Profitability And Growth